Making business decisions based on data has never been easier and more accessible.

At IDB Lens, you will have all the reports you need to manage your business in one place, with automatic updates directly from your ERP and 24/7 access.

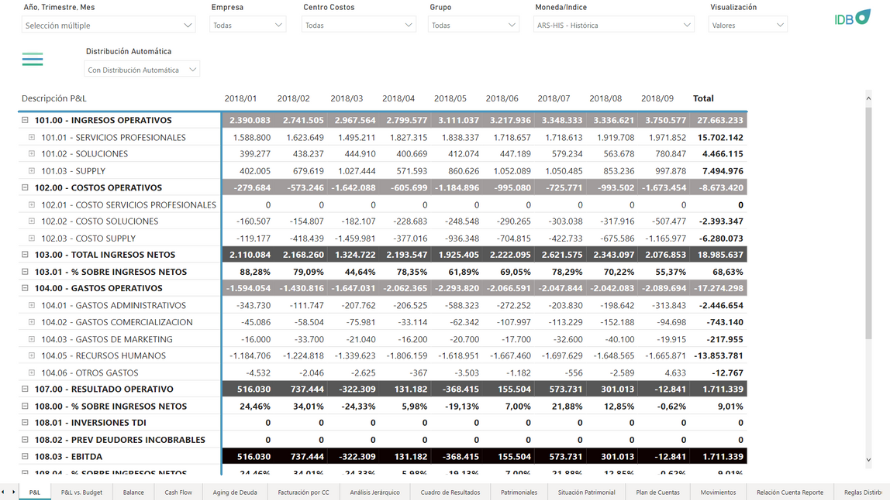

P&L y P&L vs. Budget

El reporte “Profit and Loss” es un reporte que resume los ingresos, costos y gastos de una empresa en un período determinado. Es uno de los 3 reportes que toda compañía debe tener, junto al Cash Flow y el Balance, para conocer su salud financiera. Con él se mide el EBITDA, los Resultados Operativos, las relaciones entre Gastos e Ingresos, etc.

Además, el reporte “P&L vs. Budget” permite comparar la performance real de la compañía versus la proyectada, y lo puede hacer comparando tanto periodos específicos como acumulados (YTD – “Year To Date”) o (EOP – “End Of Period”).

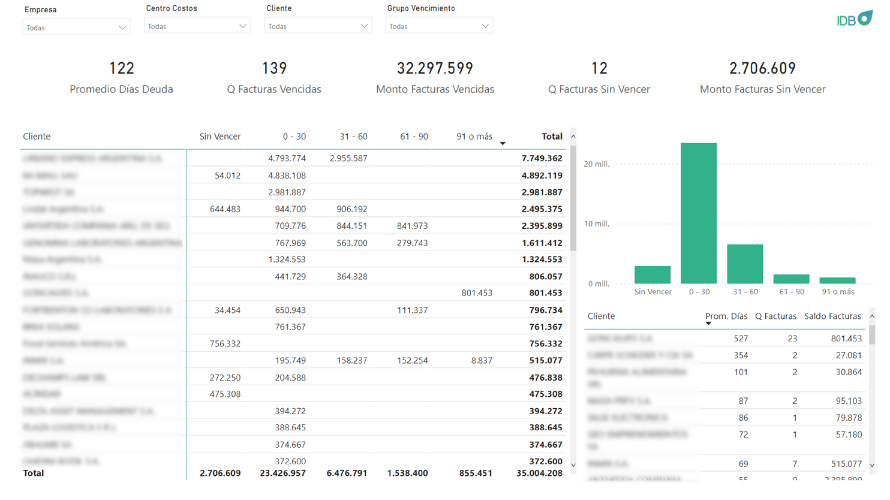

Aging de Deuda Clientes y Proveedores

Reportes con indicadores claves para Cobranzas y Proveedores, con datos autocalculados momento a momento de Promedio Días Deuda, Q Facturas Vencidas y su monto, Q Facturas sin vencer y sus montos, y posibilidad de ingresar al detalle de cada Cliente o Proveedor.

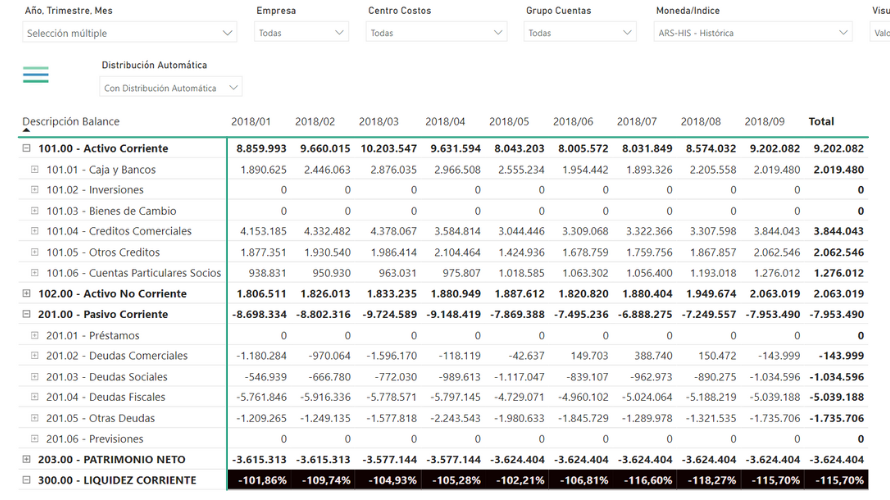

Balance

El Balance es una herramienta para conocer la salud financiera de su negocio, y uno de los tres informes esenciales que su empresa debe tener, junto con el Cash Flow y el P&L. Este informe muestra una visión completa de los Activos (recursos económicos) y Pasivos (las obligaciones contraídas) de su empresa en un momento específico. Este reporte es fundamental para evaluar la solvencia financiera de su empresa y su capacidad para hacer frente a sus obligaciones a corto y largo plazo.

Le permite a inversionistas, acreedores y otros interesados tomar decisiones informadas sobre su inversión o crédito, y así garantizar el éxito de su negocio.

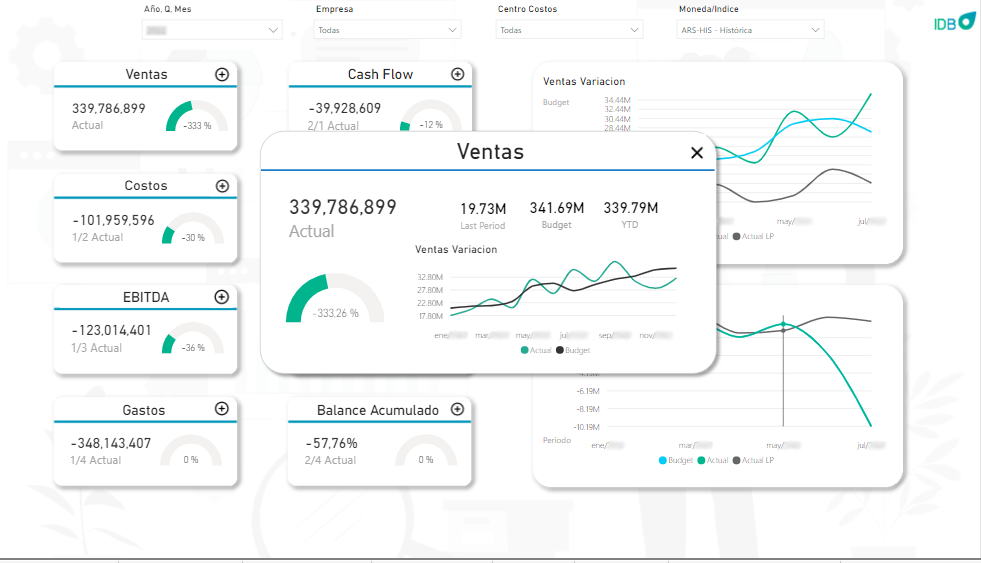

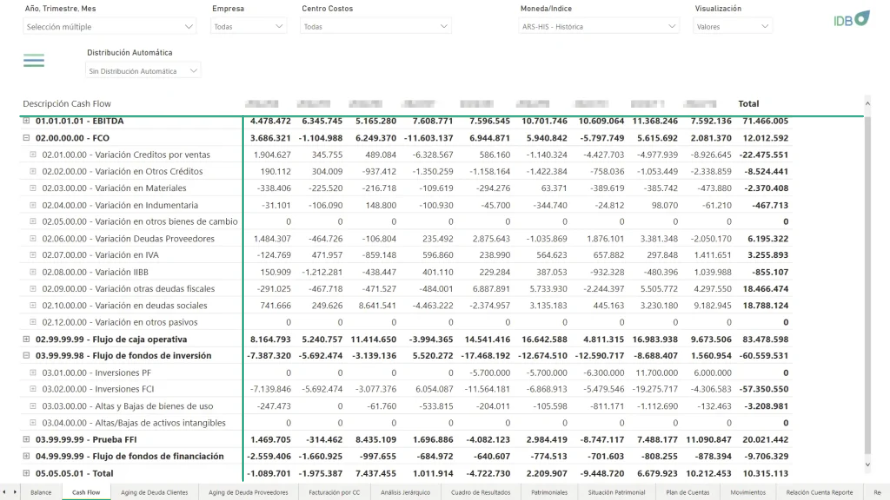

Cash Flow

El Cash Flow es un indicador clave para evaluar la situación financiera de una empresa. Iniciando desde el EBITDA permite conocer los flujos de caja en las áreas de operaciones, inversiones y financiación. Esto permite realizar un análisis profundo de las actividades económicas y su impacto en la salud financiera de la empresa. Es por esto que el Cash Flow es un reporte esencial para la toma de decisiones y la gestión de la empresa, junto al P&L y al Balance.

A report for every business management question you have

How much is my company earning or losing?

P&L

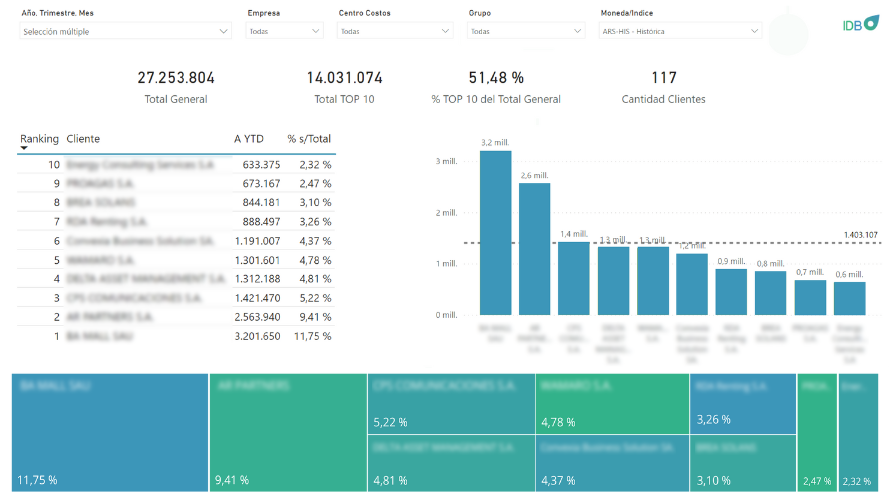

More informationWho are my most profitable customers?

Top 10 Customers

More informationWhere is my money?

Balance

More informationIs my business sustainable?

Balance Sheet

More informationWhat is the current status of my company?

Dashboards

More informationWhat is the value of my company?

EBITDA

More informationWhat are my financial and investment results?

Cash Flow

More informationHow much do I owe/ am I owed?

Aging of Accounts Receivable/Payable

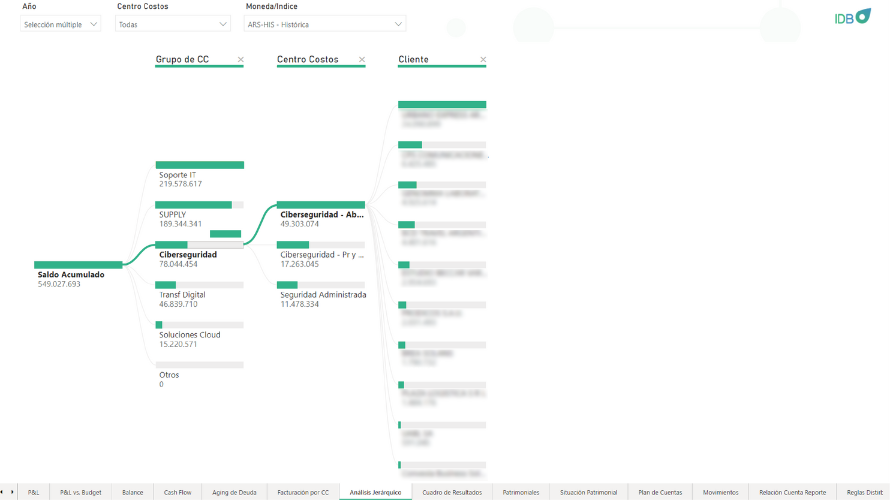

More informationHow profitable is each Business Unit?

Hierarchical Analysis

More informationIn an increasingly complex and uncertain micro and macroeconomic environment, InDataBiz is your best ally.

Why?

You will have a unified view of your entire business in one place, with filters by Business Unit, Service or Product Line, Cost Centers, etc.

No more hours spent on reporting: Finance and movements in real-time, updating directly from your databases.

Access to best practices directly from business specialists, to accompany and advise you on how to organize and improve your management.

Easy and Intuitive

The best UX experience you could have imagined with data from your business.

Reliable

We help you build a solid foundation of reliable data to make decisions.

The best price

Access to a high-quality service at a collaborative economy price, with low maintenance cost.

Consolidated view.

We allow you to consolidate multiple companies, currencies and indicators in a single application.

Safe

All our applications work with the highest cybersecurity standards to protect your information.

Some of our clients

Manufacturer

ERP

Certify your ERP software with our applications. An opportunity to enhance your business with innovative products, maximizing your customer portfolio’s profitability.

Financial

Advisor

Provide your Financial Consulting and/or Accounting Advisory services to our clients, using tools that automate your daily operational tasks.

Distributor

Incorporate our tools into your portfolio of products and services, managing the sales cycle and/or their implementation, expanding your business or your freelance services.

Related content

New Alliance: Arnaldo Castro

We have excellent news 🚀 We are very happy to announce that Arnaldo Castro is officially the exclusive partner for

Officially in Azure Marketplace! ✅

It is a great honor and achievement to have finalized our alliance with Microsoft to be able to publish our

The 5 Management Reports that every company should analyze weekly and monthly

Managing a company is a complex task that requires constant attention to various aspects. One of the most important aspects

Using Data Science Tools for Management Control in SMEs

Small and medium-sized enterprises (SMEs) have great potential for growth and development and are a crucial sector of the economy